When inflation rises, the value of currency goes down and people tend to hold money in the form of gold. In times when inflation remains high over a longer period, gold becomes a tool to hedge against inflationary conditions. This pushes gold prices higher in the inflationary period. Do we have, or expect to have, inflation? Take a look at what inflation really is. According to Wikipedia – “inflation is a sustained increase in the general price level of goods and services in an economy over a period of time”. This is generally caused by the devalue of currency. The more of a product there is, the less it’s worth. In this case the product is the US dollar. During the onset of covid 19 pandemic there was a 2 trillion … [Read more...]

News & Updates

Still a Buyer’s Market for Gold?

We have seen some unprecedented events around the globe over the past few weeks. Including “lock down” of 75 million United States citizens. Italy says Army will help enforce lockdown, effectively declaring martial law; might extend lockdown through early May. US, Mexico agree to shut southern border. These are just a few headlines that are plastered around news sites. This type of reporting is what we would definitely consider “geo-turmoil.” With the scary headlines there are some good news mixed in. It seems that there is a drug cocktail that is knocking the covid-19 virus back with some success. Hydroxychloroquine is the name of part of it. In an effort to support global response, the drug company Novartis, will donate up to 130 … [Read more...]

Three Pieces of a Balanced Metals Portfolio

Bullion coins Gold, Silver, & Platinum Bullion coins come in several sizes. They range from less than a tenth of an ounce to whole ounces. These coins are normally legal tender with a face value. The face value is largely symbolic. Bullion coins are almost always valued higher than their face value or denomination. Example: The Silver American Eagle has a $1 denomination but the content of the silver has been more than $19 for months at the time we are writing this. Bullion coins trade very close to the value of the metals that they contain. They could serve as means to barter if other forms of currency fail. 2. Semi Numismatic Coins - Pre 1933 United States Coin Semi numismatic coinage are US coins that have a small … [Read more...]

A Buyers’ Market for Rare Coins & Precious Metals.

In the 30 plus years I have been a professional rare coin dealer, only two things have remained constant. The market is cyclical.Long-term rare coins rise in value. In the early 1990s, according to some of the so-called experts, the rare coin market along with precious metals was over. Premiums were gone. Gold and silver were dogs. There was chatter that no one would ever buy another rare coin to attempt profit, for wealth preservation, or to transfer wealth to future generations. This, of course, all turned out to be hogwash. We have seen coins go from that point to record highs. Then we saw premiums on some coins slip to the point where we are now. The fact is, we are overdue for the next true bull market in rare … [Read more...]

Sell us your Rare Coins-we are buying!

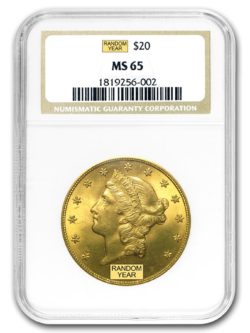

American Rare Coin and Bullion is buying rare United States coins. We will, of course, buy as many coins as we can this summer to get our inventory heavy enough to make it to the next major show. This is the time of year that we reach out to our clients to buy rare coins more than any other! If you have coins that you have been considering selling, please give us a call. We are always interested in buying rare United States gold, silver and copper coins. If you want or need to sell your coins - call us. We will pay strong premiums for coins certified by PCGS and NGC. There are many other areas that we have focus in for individual collectors with specific wish list. Here is what we buy: All pre 1933 gold coins in any … [Read more...]

Buying the Dips in Precious Metals prices

The long-term price trend for gold, silver, and platinum has been steadily upward with short-term ups and downs. Gold increased by $340.70/ounce over the past 12 months. What investors should be looking at is the steady upward trend over months and years. This “steady-upward trend” is what should matter to investors who want to diversify their portfolios by replacing a percentage of paper assets such as stocks and bonds with precious metals. Gold has taken a few hits this week due mostly to the activity on the political front. China trade talks look to be coming closer to a deal, which has pushed gold prices down. Last apparently saw a large sell order which may have also sparked a decline in prices. What does this … [Read more...]

From a Euro Bank Held Collection 400 Crisp Gold $5 Half Eagles With Motto “In God We Trust”

In God We Trust – All Others Pay Cash! During the bloody carnage of America’s Civil War, there was a movement at the U.S. Treasury Department to make sure the motto “In God We Trust” was added to America’s coins. Some people interpreted it as a nod to finding purpose in the sacrifice of so many at the Altar of Freedom. For others, it was the Federal Government’s way of saying that God was on the Union side. Whatever the real reason, when the motto was added to coins it did not escape the eagle-eyed notice of Americans, prompting someone to quip: “In God We Trust – all others pay cash!” We have brought in from a bank vault in a secret European location,400 original $5 gold Liberty half Eagles. Each one of these coins is in crisp extra fine … [Read more...]

The Best Deal in The Coin Market

There are a lot of gold coins on the market. But they all fall into two basic categories: “Bullion or numismatic (rare) coins”. Bullion coins simply refer to gold coins that are made almost exclusively from precious metal, in this case gold. Their value component is that they consist of highly refined gold and are viewed primarily as an investment or a hedge against tough economic conditions. Numismatic coins refer to rare coins, ones that are bought and sold by collectors. Unlike bullion coins, their value isn’t based on the gold content, but rather on their rarity and condition. Their premiums are usually much higher than bullion coins, and can stretch into the thousands of dollars and in some … [Read more...]

Pride of Two Nations – 2 Coin Set

SOLD OUT AT THE MINT!!!!WE HAVE A LIMITED OFFERING OF FIRST DAY OF ISSUE PROOF 70 TWO COIN SETS HAND SIGNED BY THOMAS CLEVELAND U.S. MINT MASTER DESIGNERCLEVELAND HAS LIMITED HIS SIGNATURE TO ONLY 100 OF THESE SETS$679.00 PER SETPLEASE CALL TO CONFIRM866.789.2646*An American Eagle One Ounce Silver Coin with an enhanced reverse proof finish and a Canadian One Ounce Silver Maple Leaf with a modified proof finish*U.S. coin is one troy ounce of .999 fine silver, and the Canadian coin is one troy ounce of .9999 pure silver*Minted at the United States Mint at West Point and Canada’s Ottawa MintThis beautifully rendered and unique special set is the first-ever joint coin set between the United States Mint and Royal Canadian Mint. It commemorates … [Read more...]

Gold Market Update

The price of gold has enjoyed sustained strength this calendar year, up nearly 11.07% year-to-date. Up 13.65% from its low of $1,266 formed back in May 2019. However, the price is still well below the all-time high of $1,921 from September 2011. Fueled by a Weaker U.S. dollar- the weakness in the dollar index lowered its trading power 0.18% (at 97.04 today). It is this weakness in the dollar index that is helping the gold price to shine. A few weeks ago the dollar index touched the low of 95.84. On an extremely long-term basis, gold has been moving upward since hitting rock bottom in December 2015, when prices reached a low of $1045 per ounce. Since then gold has moved to higher pricing $1370-$1380 per ounce. … [Read more...]