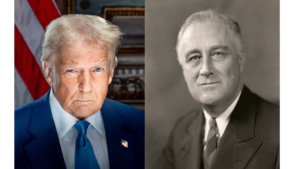

Most people are familiar with Franklin D. Roosevelt’s “New Deal” and the historic 1933 gold recall. In April of that year, Roosevelt ordered the confiscation of gold, paying citizens $20.56 for each $20 gold piece. Shortly after, he reset the official price of gold to $35 per ounce, instantly increasing the value of U.S. gold reserves by 70%.

Fast forward to today: as of Q3 2024, the United States holds approximately 8,133.46 metric tons of gold, making it the largest sovereign holder of gold in the world. However, the U.S. Treasury still values its gold reserves at a statutory price of $42.2222 per troy ounce, a figure set in 1973. At this outdated valuation, the total book value of U.S. gold reserves stands at just $11.04 billion—a far cry from its true market value of approximately $763.2 billion based on current gold prices of $2,918.60 per ounce.

Will the U.S. Government Revalue Gold?

There are ongoing discussions among high-level politicians about revaluing gold reserves to reflect its actual market value. If this happens, it could have a profound impact on the Treasury’s balance sheet and might even serve as a strategy to address government debt.

What Would Happen If the U.S. Government Repriced Gold?

1. Immediate Market Impact on Gold Prices

- Bullish for Gold: Recognizing gold’s true value would reinforce its role as a premier store of wealth, potentially driving higher demand from investors and central banks.

- Market Speculation: A repricing could signal further actions, such as issuing gold-backed bonds or partially backing the U.S. dollar with gold, leading to a speculative price surge.

2. U.S. Dollar & Inflation Implications

- Weakening of the Dollar: A gold revaluation would highlight gold’s stability over fiat currencies, possibly reducing confidence in the U.S. dollar and triggering a flight to hard assets.

- Inflation Concerns: If repricing is perceived as a tool to reduce debt, investors may worry about monetary instability, further fueling gold price increases.

3. Global Market Reactions

- Central Banks Increasing Gold Reserves: Many foreign governments may accelerate gold purchases to keep their reserves competitive, pushing demand even higher.

- Gold-Backed Financial Instruments: We could see the rise of gold-backed currencies, bonds, and ETFs, further reinforcing gold’s role in the financial system.

4. Potential Long-Term Outcomes

- Gold Pegging Possibility: If the U.S. government pegs gold to a higher fixed price, it might stabilize the market in the short term but could also introduce volatility if investors doubt the sustainability of such a move.

- Monetary Reset? If gold is reintroduced as part of a new monetary system, it could fuel a long-term bull market in gold.

Conclusion: A Likely Gold Price Surge

- Short-Term Impact: A significant upward price movement due to speculation.

- Long-Term Effect: Gold could enter a sustained uptrend as confidence in paper currencies shifts.

What Should You Do?

This brings us to one of the best values in the gold coin market today: Pre-1933 $20 Gold Double Eagles. These historic, one-ounce gold coins have almost no premium compared to modern bullion coins like Gold American Eagles or Canadian Maple Leafs.

Why Pre-1933 $20 Gold Coins?

- They will never be minted again – unlike modern bullion coins, these coins have true scarcity.

- In previous gold bull markets, $20 Double Eagles disappeared from the market, forcing dealers to pay more for them when demand soared.

- Low premiums today, but high upside potential if gold prices surge.

Acquiring Pre-1933 $20 Double Eagles now could be one of the smartest moves you make in the precious metals market. Special arrangements available for bulk orders of 100+ coins with qualifying payment.

Silver Production and Global Trade Dynamics

Silver Production and Global Trade Dynamics