Silver Bullion

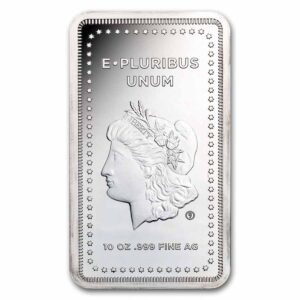

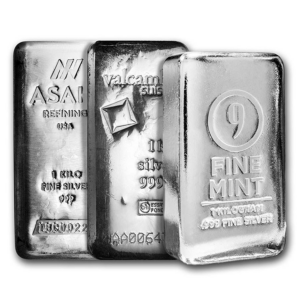

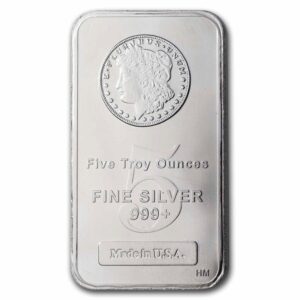

Silver bullion refers to investment-grade silver that is at least 99.9% pure and typically comes in the form of bars, ingots, or coins. It is valued primarily for its metal content rather than any numismatic or collectible value. Silver bullion is produced by mints and refineries worldwide and is commonly used as a store of wealth, a hedge against inflation, and a means of diversifying investment portfolios. The price of silver bullion is largely determined by the spot price of silver, which fluctuates based on supply and demand, economic conditions, and market speculation.

Investors and governments alike hold silver bullion as a tangible asset with intrinsic value. While individuals can purchase physical silver in various sizes, from small one-ounce coins to large 1,000-ounce bars, others may choose to invest in silver through exchange-traded funds (ETFs) or futures contracts, which offer exposure to silver without the need for physical storage. Additionally, silver has significant industrial applications in electronics, solar panels, and medical devices, contributing to its steady demand. Because of its affordability compared to gold, silver bullion is a popular choice for both new and seasoned investors seeking to preserve wealth and capitalize on potential price appreciation.

Showing 16–20 of 20 results