IRA-Approved Precious Metals

IRA-approved precious metals are specific gold, silver, platinum, and palladium products that meet the IRS’s stringent purity and quality standards for inclusion in a self-directed Individual Retirement Account (IRA). To qualify, gold must be at least 99.5% pure, silver must be 99.9% pure, and platinum and palladium must be 99.95% pure.

IRA-approved precious metals are specific gold, silver, platinum, and palladium products that meet the IRS’s stringent purity and quality standards for inclusion in a self-directed Individual Retirement Account (IRA). To qualify, gold must be at least 99.5% pure, silver must be 99.9% pure, and platinum and palladium must be 99.95% pure.

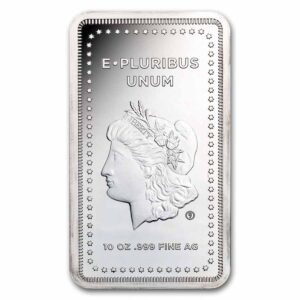

These metals must be in the form of bars, rounds, or coins produced by accredited refineries, government mints, or other approved manufacturers. Examples of IRA-approved precious metals include gold and silver bars from recognized refiners, American Gold and Silver Eagles, Canadian Maple Leafs, and certain products from the Perth and Austrian Mints. Collectible or numismatic metals, as well as those that do not meet purity requirements, are generally ineligible. Investing in IRA-approved precious metals provides a way to diversify a retirement portfolio while benefiting from the tax advantages of an IRA.

Showing 1–15 of 18 results

-

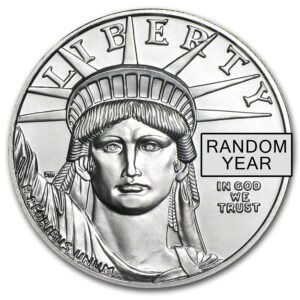

1 oz Platinum American Eagle BU (Random Year)

$1,375 Read more -

1 oz Pure Silver Buffalo Rounds

$47.62 Add to cart -

2015 $1 Silver American Eagle

$48 Add to cart -

ARC 1 oz Silver American Eagle BU 1986-2025

$47 Add to cart -

ARC 1oz Australia Gold Kangaroo BU

$3,765 Add to cart -

ARC 2025 1/10ozGold American Eagle BU

$415 Add to cart -

ARC 2025 1/2 oz American Gold Eagle BU

$1,950 Add to cart -

ARC 2025 1/4 oz American Gold Eagle Coin BU

$1,020 Add to cart -

ARC 24k Gold Buffalo 1oz BU

$3,860 Add to cart -

ARC Canadian Gold Maple Leaf 1oz BU 1979-1982

$3,780 Add to cart -

ARC China 1 oz Gold Panda BU

$3,760 Add to cart -

ARC Gold Austrian Philharmonic 1oz BU

$3,760 Add to cart