Gold Bullion

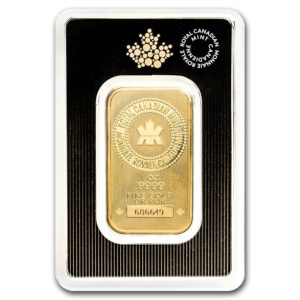

Gold bullion refers to highly refined gold, typically with a purity of at least 99.5%, that is cast into bars, ingots, or coins for investment purposes. Unlike collectible coins, which may have historical or artistic value, gold bullion is valued primarily for its metal content and is traded based on the current market price of gold, known as the spot price. It is produced by government and private mints worldwide and serves as a tangible store of wealth, often used to hedge against inflation and economic instability. Because gold has been a symbol of wealth for centuries, it remains one of the most trusted assets for preserving and growing financial security.

Governments, central banks, and investors hold gold bullion as a reserve asset and a means of diversifying investment portfolios. Individuals can acquire gold in physical form, ranging from small fractional-ounce coins to large 400-ounce bars, or invest in paper gold through exchange-traded funds (ETFs) or futures contracts. Gold's value is influenced by factors such as global economic conditions, currency fluctuations, and central bank policies. Additionally, gold has industrial applications in electronics, dentistry, and aerospace, contributing to its steady demand. Because of its historical significance and scarcity, gold bullion remains a highly sought-after asset for both institutional and individual investors.

Showing 1–15 of 19 results

-

2016 $50 Gold Buffalo BU 24k

$1,632 Read more -

2016 1 oz Gold American Eagle BU

$1,640 Read more -

2017 $5 1/10oz Gold American Eagle BU

$189 Read more -

2019 $5 1/10oz Gold American Eagle BU

$220 Read more -

2020 1/10oz $5 American Gold Eagle BU

$286 Read more -

ARC 1 oz Gold Eagles BU Random Date

$3,715 Add to cart -

ARC 1oz Australia Gold Kangaroo BU

$3,645 Add to cart -

ARC 2025 1/10ozGold American Eagle BU

$415 Add to cart -

ARC 2025 1/2 oz American Gold Eagle BU

$1,950 Add to cart -

ARC 2025 1/4 oz American Gold Eagle Coin BU

$1,020 Add to cart -

ARC 24k Gold Buffalo 1oz BU

$3,560 Add to cart -

ARC Canadian Gold Maple Leaf 1oz BU 1979-1982

$3,550 Add to cart -

ARC China 1 oz Gold Panda BU

$3,760 Add to cart -

ARC Gold Austrian Philharmonic 1oz BU

$3,500 Add to cart